- Article

- Innovation & Transformation

- The Future of Technology

How AI keeps shelves stocked and cash moving across Asia

Efficient inventory management is the cornerstone of any successful business, from the smallest store to global organisations with operations across the globe. Ensuring the right products are on the right shelves at the right time minimises costs and wastage, keeping customers satisfied and coming back for more.

The growth of e-commerce across Asia has made inventory management a priority for consumer-facing businesses, whose customers have come to expect express delivery. These challenges are only increasing as cross-border e-commerce expands, and a growing middle class demands a broader range of premium and fresh produce with consistency of supply. Asia leads the world in e-commerce, with the region’s market estimated at USD1.8 trillion in 2023, roughly double the size of that in the US.¹

The coronavirus pandemic highlighted critical shortages in cold-chain warehousing and logistics in many emerging markets, as well as the technology to track, trace and verify the supply and delivery of vaccines and other perishable medicines and equipment. The same is true of many food and beverage products, with capacity constraints affecting the last mile of distribution networks for global brands as well as the potential for local producers to compete and expand in their home markets and beyond.

The pandemic also accelerated the adoption of digital technology in inventory management, including the use of artificial intelligence for real-time data analysis, automated decision-making, and warehouse management. When primed with accurate, reliable data, AI platforms can be invaluable in improving efficiency within a complex value chain.

As more businesses look to deploy these solutions, the early movers that are able to leverage AI platforms to reduce the amount of cash tied up in unsold inventory and ensure their customers receive their goods on time will be well-placed to build on their competitive advantage.

Levelling the playing field

The rise of cheap, intuitive AI software and app-based solutions has the potential to be a levelling force for smaller businesses that don’t have sufficiently deep pockets to support IT departments or pay for industrial-scale enterprise software designed for multinationals and bigger businesses.²

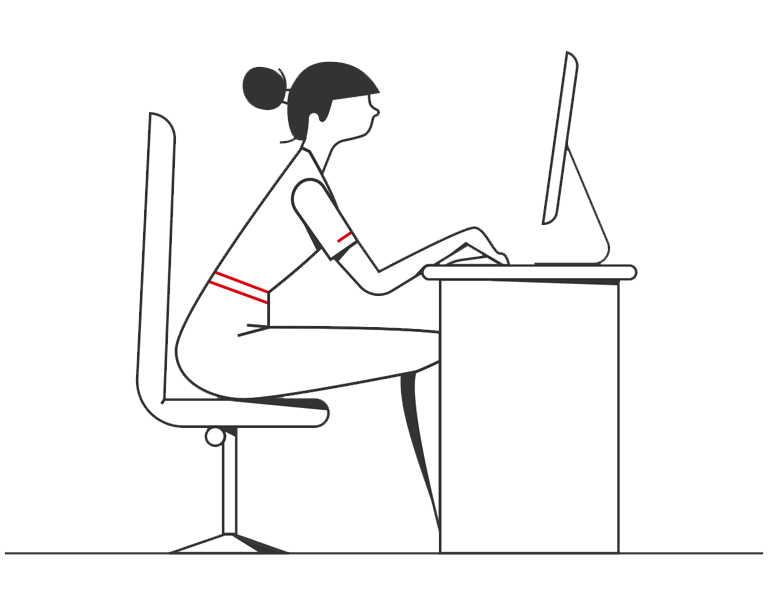

For businesses looking to take advantage of these solutions, digitisation is a necessary first step to improving inventory management. In these complex systems, a simple human error at any point can have cascading and serious consequences, including on employees’ morale and customer satisfaction. For example, consider that an estimated 80% of warehousing process errors are caused by human error.³ Integrating AI solutions with human workers, such as through wearable and handheld devices, can greatly reduce these losses.⁴ Fully automated systems, combined with technologies such as Radio Frequency Identification and Internet of Things can further optimise the storage, location, selection, and dispatch of inventory.⁵

Weak or erroneous inventory management will also have a major impact on financial performance and reporting, with knock-on consequences for regulatory compliance, valuations, and access to finance. Assets can turn to liabilities; misreporting is a major reputational and regulatory risk. Correcting such errors can tie up management and suck up valuable resources.

Collecting and analysing data to optimise core operations can also be beyond the reach of many smaller companies. Well-designed and carefully operated AI platforms are already on the market and can give immediate access to the technology at an affordable entry point.

For many businesses, the ideal solution may be one that imposes minimal disruption to existing processes: providers should be resolving the pain points for their clients, making the digital transformation as seamless as possible.

However, AI systems are only as good as the data they draw on. Businesses considering implementing AI as part of their digital strategy must first determine what data they require, how to collect it and how to ensure it can be used across platforms and functions. International businesses operating in Asia face the added complication of local data privacy rules that restrict the flow of information across national borders. Vietnam, for example, requires an impact assessment for cross-border data transfers, and businesses operating in China may be subject to a government-led security assessment.⁶ Careful planning and expert advice may be needed to ensure businesses remain compliant with an evolving regulatory landscape.

Three essential steps for businesses:

- Tread carefully. Take time and seek advice from more than one trusted supplier or intermediary. Managers should avoid easy solutions and take adoption one step at a time. It is important to focus on addressing specific pain points but to have a clear vision for the end game in sight.

- Apply solutions that are within your existing capabilities. Remember that any new technology will disrupt existing processes and skillsets. A badly implemented change process or poorly conceived data sets may prove crippling.

- Adoption may be better than innovation. Why reinvent the wheel where many others have ploughed their own capital into doing that for you?

How HSBC can help

Digitalising supply chains provides rich data that businesses can use to access trade finance and improve cash management. HSBC has an established track record of applying AI and data to enhance operations of customers. Through adopting the bank’s digital solutions, businesses can begin their path to AI adoption and digitalisation based on tried and trusted, best-in-class practices.

For businesses integrating other AI solutions into their inventory operations, HSBC Supply Chain Finance provides API connectivity to plug into corporate treasury applications, giving customers improved visibility over their payments and invoices in real time.⁷

Advanced technology now promises a wide range of productivity and efficiency gains, lowering costs that can be passed on to customers and end consumers. AI is also levelling the playing field for smaller businesses, presenting new insights that can lead to better outcomes for firms that are able to move quickly in search of new opportunities.